Cocoa –

the new gold?

The 2024 cocoa crisis – an in-depth history and the latest developments

Text:

Katharina Kuhlmann

Photography:

© EcoFinia, VIVANI | iStock Pedarilhos | iStock dimarik | iStock alfexe

17 May 2024

The first signs appeared at the end of last year and it has unfortunately become official since the start of 2024: the world is currently in the midst of the greatest cocoa crisis ever known and prices are exploding. How did it come to this? Who is to blame? And what does this mean for our favourite confectionery, chocolate? There are no simple answers to these questions and there are a lot of different aspects to consider. In this report, we explain the interrelating factors and provide detailed information about what we and you, our customers, can expect to happen over the coming months.

A crisis is developing

Back in December 2023, news outlets reported on cocoa crop failures in Africa and rising prices. Ivory Coast and Ghana are the two countries that produce the most cocoa beans in the world – together they account for over 60% of global cocoa production. Last year, both countries suffered excessive rainfall prior to the main cocoa harvest in autumn. This caused a number of cocoa fruits to rot and for many trees to suffer from fungal infections.

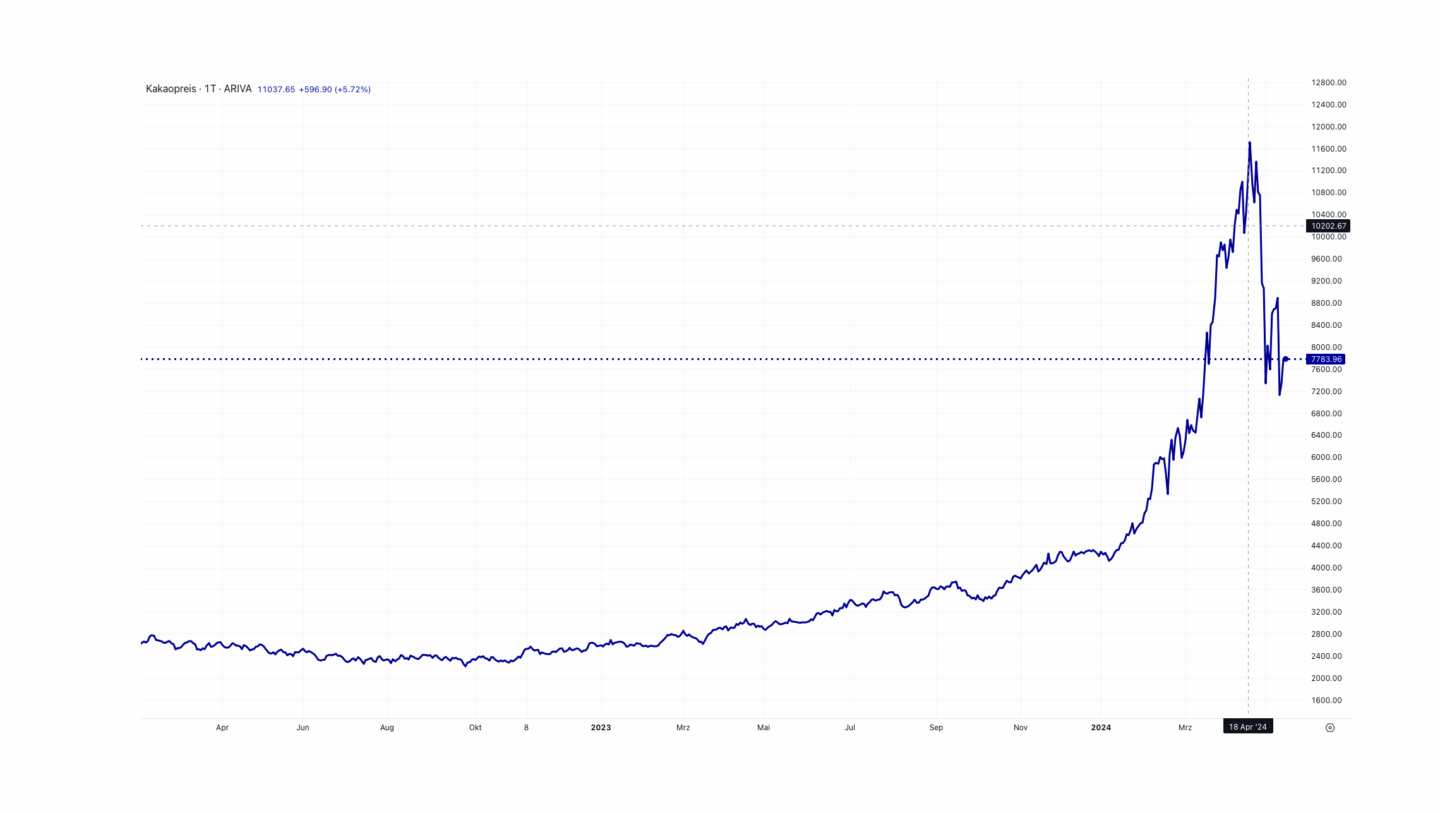

Initially, the main concerns were about the increased price of chocolate Santas but, since the start of 2024, the crisis has taken on a completely different dimension. Market-leading chocolate manufacturers quickly implemented a strategy of actively stockpiling cocoa beans. This in turn led to the global market price for raw cocoa rising rapidly to historic highs from February onwards, quickly overshadowing the largest cocoa crisis to date in 1974. Currently (as of 30th April 2024), the price per ton of raw cocoa is 10,990 US dollars – an increase of over 367% compared to the previous year. These figures show that the issue is no longer confined to chocolate Santas, but rather concerns the existence of an entire industry. Good harvests are now imperative to help ease the situation. But the signs are not looking good.

Cocoa and climate change

Climate change is, needless to say, an uncontrollable stressor for the entire cocoa ecosystem. Climate change is omnipresent and we are now finally noticing it in the places we live. But it has been a daily threat in countries in the Global South for some time now. Climate targets are not being hit and this is particularly noticeable in the area around the equator, where it is getting hotter and hotter and water is becoming more and more scarce. The sensitive ecosystems of the rainforests in these regions are increasingly under threat – and this is the only place where cocoa trees grow. The trees are very demanding and only bear fruit near the equator. Read our article “The cocoa tree – a tropical diva” for more information.

And, as if that weren’t enough, other weather phenomena not directly caused by climate change can further aggravate the situation in tropical countries. The current El Niño phenomenon is one example of this.

Cocoa and El Niño

The El Niño weather phenomenon occurs regularly in the Pacific Ocean. Research is currently underway to discover the extent to which climate change influences this phenomenon. What is clear, however, is that changes in ocean currents in the Pacific have sparked a series of weather events affecting many regions of the Earth. From massive droughts, as is currently the case in the Amazon region, to storms and heavy rainfall events – El Niño is turning the world’s climate upside down. The effects of this are also focused in Latin American countries where a lot of cocoa is grown. Storms and other dramatic weather events are repeatedly destroying large numbers of trees here.

Exploitative cocoa cultivation in monocultures

In order to satisfy the world’s appetite for cocoa, conventional cocoa cultivation previously relied on monocultures. However this method, which is particularly widespread in African countries, only increases the efficiency of cultivation in the short term. Clearing the forest areas destroys all biodiversity and prevents it from returning, the soil dries out and becomes depleted and contaminated with pesticides and fertilisers. The cocoa trees, which grow in the natural shade of larger trees in virgin forests, have to be over-irrigated in the already water-scarce countries and are constantly threatened by disease. Last year’s unusually heavy rainfall in Ghana and the Ivory Coast clearly demonstrates how these fragile monocultures are left destroyed in the face of severe weather events and climate change.

The case of Ghana

Another problem exacerbating the situation and one that only few people are aware of here, is the worsening situation on the ground in Ghana – the world’s second-largest producer of cocoa. The area being used to cultivate cocoa is shrinking rapidly due to illegal gold mining and environmental crime. The situation is truly shocking. Illegal gold miners – known as Galamsey – are repeatedly raiding farms in order to search the ground for the coveted precious metal in the shortest possible time. They destroy trees and contaminate the soil with chemicals such as cyanide. Cocoa farmers have to watch on helplessly as their livelihoods are destroyed. Given the hopeless situation, some even voluntarily sell their farms to the Galamsey. Even local authorities can do little to counter the illegal groups and their violent watchmen, so the problem is spreading rapidly. Four years ago, a study found that at least 20,000 hectares of cocoa farms had already been destroyed by illegal gold mining. Current figures are not known.

It is estimated that the area under cultivation in West Africa will shrink massively in the future due to illegal gold mining, tree disease and climate change. A study estimates that more than 50% of the land in the Ivory Coast will be lost by 2050. Ecuador is expected to replace Ghana as the second-largest cocoa producer by 2027. It is likely that this trend will prevail and that global cocoa production will end up moving from the depleted African cultivation areas towards Latin America.

Speculators and stockpiling are exacerbating the crisis

The price of cocoa had already risen as a result of these poor conditions and the low supply. But, at the start of 2024, additional unfavourable strategies by certain proponents on the cocoa market caused the price of the commodity to explode.

On the one hand, fear drove people to begin stockpiling, which further reduced the availability of the raw material. It was predominantly the large cocoa processors and chocolate manufacturers in Europe who began to fill their huge storage capacities “for a rainy day”. In Latin America, where harvests were less badly affected than in Africa, other measures were taken, such as targeted visits to cocoa farmers. Due to the high prices offered during these visits, cocoa was literally snapped up “on the street”. This had the knock-on effect that the cocoa farmers were not able to deliver the full amount of cocoa that they contractually agreed to their cooperatives. This in turn jeopardises trade relations with cocoa processors, as existing contracts cannot be honoured and the harvest quantities agreed are not able to be delivered to the actual buyers. The large European corporations behind such tactics are thus emerging as winners from this tense price situation.

On the other hand, hedge funds and the dominating presence of speculators on the stock exchange added additional fuel to the fire and caused a huge surge in the price of cocoa. The latter were mostly not even active traders, but rather algorithm-controlled trading bots. They carried out automatic, lightning-fast trading transactions, bidding against one another, and thus driving the actual price of cocoa to dizzying heights.

The chart shows the rapid development of the cocoa price over the last two years (April 2022 – May 2024).

In short: chocolate prices are on the rise

The volatile situation affecting cocoa farming also impacts consumers. So is chocolate really getting more expensive? Our Managing Director Gerrit Wiezoreck speaks plainly, “price increases are unavoidable. The question is not so much ‘if’, but rather ‘by how much’ and ‘when’. We are a small company. Unlike the big players in the industry, we source our cocoa in small quantities directly from farmers in the Dominican Republic. We have limited storage space so we can only hold stock for a short period of time. As such, we will not be able to avoid increasing our prices soon – as much as we would like to. But one thing is certain: other companies and brands will have to follow suit sooner or later.”

The increase in the value of cocoa can no longer be denied and is unlikely to be reversed anytime soon. A reliable local source in the Dominican Republic has told Wiezoreck that cocoa distribution centres are currently suffering regular break-ins, and that buyers and even farmers are being attacked in order to secure a few sacks of the new gold. In addition to the increase in value, these incidents also highlight another sad factor that current events bring with them. While the cocoa produced by Dominican farmers is currently so valuable it is being stolen, the cocoa produced by African producers is only considered a real commodity on the world market. This is due to the protectionist policies that the respective countries have for their growers, which are reflected in the so-called farmgate price. This is the minimum price set by the country in question that cocoa farmers receive for their cocoa beans. While in Africa only about 20% of the current price increase reaches the farmers, in the Dominican Republic it is about 80% – an incredible difference.

Sources

https://www.boerse-frankfurt.de/rohstoff/kakaopreis

https://www.tagesschau.de/wirtschaft/weltwirtschaft/kakaoernte-elfenbeinkueste-100.html

https://www.n-tv.de/mediathek/bilderserien/panorama/Warum-sich-die-Kakaokrise-in-Ghana-verschaerft-article24859548.html

https://www.boerse-frankfurt.de/rohstoff/kakaopreis/charts

Verwandte Artikel

The Chocolate Journal