Cocoa crisis update: Are cocoa prices falling?

Why the price of chocolate will still remain high

Text:

Katharina Kuhlmann

Photography:

© Kilian Kuhlmann

5 November 2025

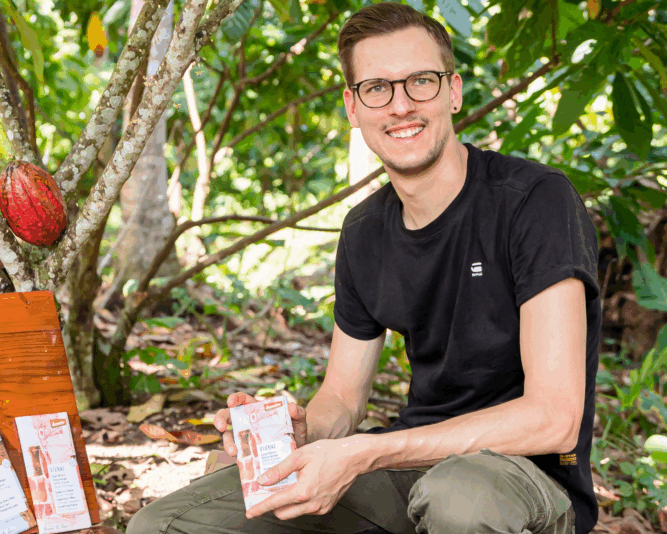

In recent weeks the media has been reporting on the marked fall in prices on the cocoa market. Does this mean that the cocoa crisis is now over? There is speculation about whether chocolate is finally going to be cheaper again in time for Christmas. In this article, VIVANI Managing Director Gerrit Wiezoreck answers the seven frequently asked questions on the current state of the cocoa market and sheds some light on the various factors that need to be considered as part of this complex issue.

1. Cocoa prices have now settled at a significantly lower rate. What is the reason for this?

There are two inter-related reasons that have led to cocoa prices falling by up to 1,500 USD per tonne within a few weeks in the early autumn of 2025. On the one hand, we have the optimism surrounding the main harvest that is about to take place in the West African countries of Ghana and the Ivory Coast. This harvest is expected to lead to significantly higher yields than in the recent past. On the other hand, the cocoa industry in Europe is experiencing a noticeable decline in the demand for cocoa, particularly conventional, i.e. non-organic, cocoa.

2. If the cocoa crisis has now ended, does this mean that cocoa will become cheaper again over the long term?

Unfortunately the crisis is far from over. The price of cocoa is still very high, standing at between 5,500 and 6,500 USD per tonne (by way of comparison, in spring 2023, the price was around 2,400 USD per tonne). And then there is the fact that the current fall in price is solely based on expectations that the main African harvest will be a success. But these hopes may be misplaced. In general, the quality of cocoa continues to decline and the quality level fluctuates massively.

3. What needs to happen to put an end to the cocoa crisis?

Two different things need to happen to end the current cocoa crisis: On the one hand, demand needs to fall. On the other hand, the West African harvest needs to be above average for the next two years. But this would also require more high-quality arable land.

4. Why can’t chocolate manufacturers simply revert to the lower “pre-crisis prices” with the good harvest forecasts?

The chocolate industry can only stock up on cheaper cocoa if cocoa market prices remain consistently low for an extended period. And this must align with the harvest cycles. Here’s an example: The main harvest in the Dominican Republic runs from May to July. If a chocolate producer wants to bank on using this cocoa, it needs to be purchased during this period. If the price falls sharply after the harvest, there won’t be any of this cocoa available on the market, as the harvest will essentially sell out.

In addition, it is standard practice to fix cocoa prices and quantities for 6 to 12 months. Manufacturers stock up based on these prices. This means that if prices on the cocoa market fall temporarily, the chocolate industry cannot react within a period of weeks or even months, as their warehouses are already full of more expensive cocoa.

5. Consumer behaviour has changed as a result of the cocoa crisis. Are people buying less organic chocolate too?

The decline in chocolate consumption is currently affecting conventional chocolate significantly more than the organic sector, even though cheap chocolate is still available for less than 2 EUR per 100 grams. But things look quite different in the organic sector. Despite comparatively high increases in product prices, consumption has remained high here. This consumer loyalty is helping the producers of ethically sustainable cocoa and organic chocolate producers during this time of crisis.

6. Are there also opportunities to be found in the higher price of cocoa?

The cocoa crisis is a structural issue. Heavy rainfall, drought and the resulting catastrophic harvests of 2023 and 2024 were in actual fact just the proverbial straw that broke the camel’s back. Cocoa prices have been far too low for years. As a result, there haven’t been any incentives to establish and operate durable, high-producing cocoa farms. Many farms consist of very old, neglected cocoa plants with low yields. A stable long-term cocoa price at a market price of over 3,000 to 4,000 USD per tonnes would help small-scale farmers to manage, maintain and upgrade their farms, which would in turn lead to significantly better yields.

7. How can cocoa farming recover despite the crisis?

The system can only be overhauled if the market price of cocoa remains above 3,000-4,000 USD per tonne over the long term. This is the required price to give farmers fair and long-term incentives to manage their plantations so they are productive over the long term. At the same time, we need a change in consumer behaviour towards more sustainably produced organic cocoa from agroforestry systems. This form of cultivation incorporates valuable shade from other useful trees and plants and is significantly more resilient to climate change. Monocultures don’t stand a chance of surviving the changing conditions over the long term.

Verwandte Artikel

The Chocolate Journal